The non-recourse factoring provides firms with total credit security, the primary factor promoting growth. This is because non-recourse factoring services are used more frequently in developing countries.

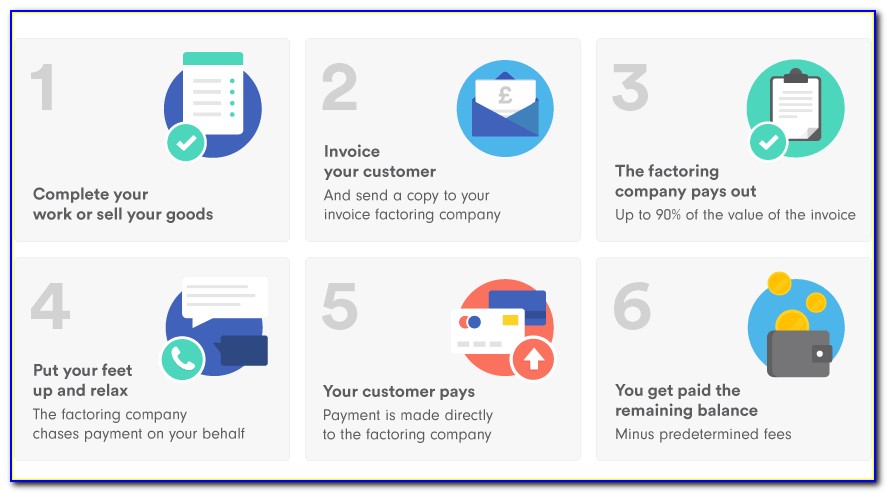

Over the forecasted period, the non-recourse segment is anticipated to grow at the highest CAGR of 10.75% in the invoice factoring market. Over the projected period, the non-recourse segment is expected to register the highest CAGR of 10.75% in the invoice factoring market. In addition, the increased awareness of global trade and the relocation of production facilities, particularly following the COVID-19 epidemic in China, to other economies like Vietnam, Mexico, and the Philippines are promoting the expansion of this segment. Increased open account trading has encouraged this market segment to expand further, and importers in industrialised nations are considering factoring as a viable alternative to traditional forms of trade financing. Regardless of the size or the sector company serve, international factoring services are a must for companies doing business internationally. The international segment is anticipated to grow at the highest CAGR of 10.49% in the invoice factoring market. The international segment is expected to register the highest CAGR of 10.49% over the projected period in the invoice factoring market. Small and medium-sized firms (SMEs), which make up more than half of all businesses in Asia Pacific, frequently seek financial assistance to maintain the smooth functioning of their operations. The Asia Pacific region is also home to a significant number of rising economies, including China, Thailand, India, and the Philippines, which are attracting investments from developed markets that are saturated and looking for new business prospects in the area. Their economies are fast transitioning from agricultural to manufacturing and export-oriented economies, which has promoted the expansion of invoice factoring in the area. It is because economies like India and those of other Southeast Asian nations have seen manufacturing sectors grow.

Key Insight of the Invoice Factoring MarketĪsia-Pacific is anticipated to expand at the highest CAGR of 11.37% over the projection period.Īsia-Pacific is expected to grow at the highest CAGR of 11.37% over the forecast period. The COVID-19 outbreak brought a more collaborative approach, with banks and Supply Chain Finance (SCFs) working together to benefit the client ecosystems.įor Right Perspective and Competitive Insights, Get Sample Report at: It is anticipated that the widespread adoption of machine learning (ML), natural language processing (NLP), and artificial intelligence (AI) will lead to profitable expansion opportunities for factoring during the projected period. Newark, (GLOBE NEWSWIRE) - The Brainy Insights estimates that the USD 2,740.47 billion in 2022 invoice factoring market will reach USD 6,004.70 billion by 2032.

0 kommentar(er)

0 kommentar(er)